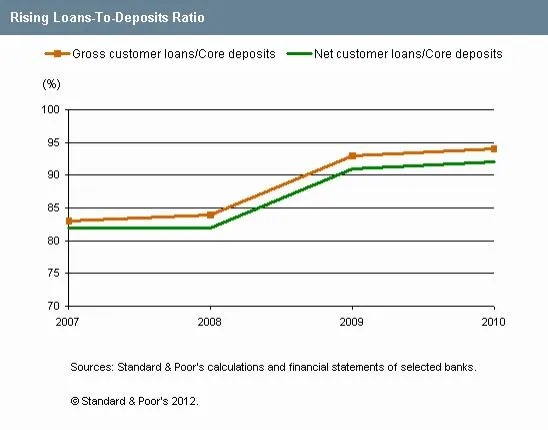

Vietnam's rising loans-to-deposits ratio

The pace of credit growth has outstripped the availability of funds since 2008, says Standard & Poor's.

According to S&P, Vietnam's banking system has been grappling with tight liquidity since 2008. The rapid pace of credit growth is reflected in the system's rising loans-to-deposits ratio. "The smaller and financially weaker banks typically bear the brunt of funding pressures because they lack the sophistication and wherewithal to handle a prolonged strain on liquidity. Instead, they rely on short-term measures and price wars to secure deposits, which have a destabilizing effect on funding and tend to erode margins."

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise